Current expenditure or investment is £1m per annum.

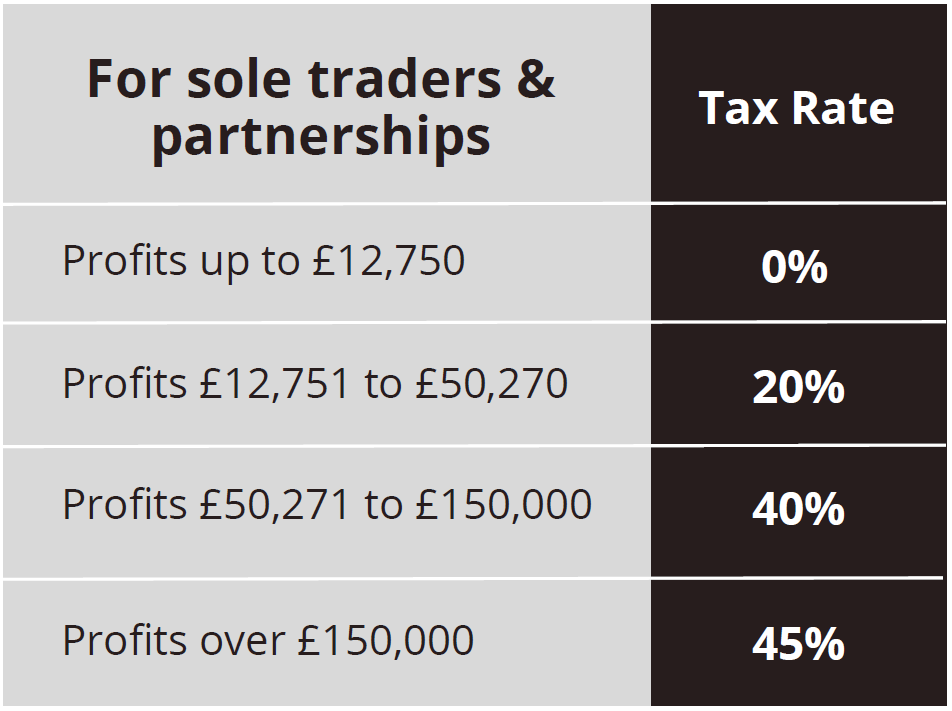

This can be set against annual profits for all ltd companies, sole traders and partnerships.

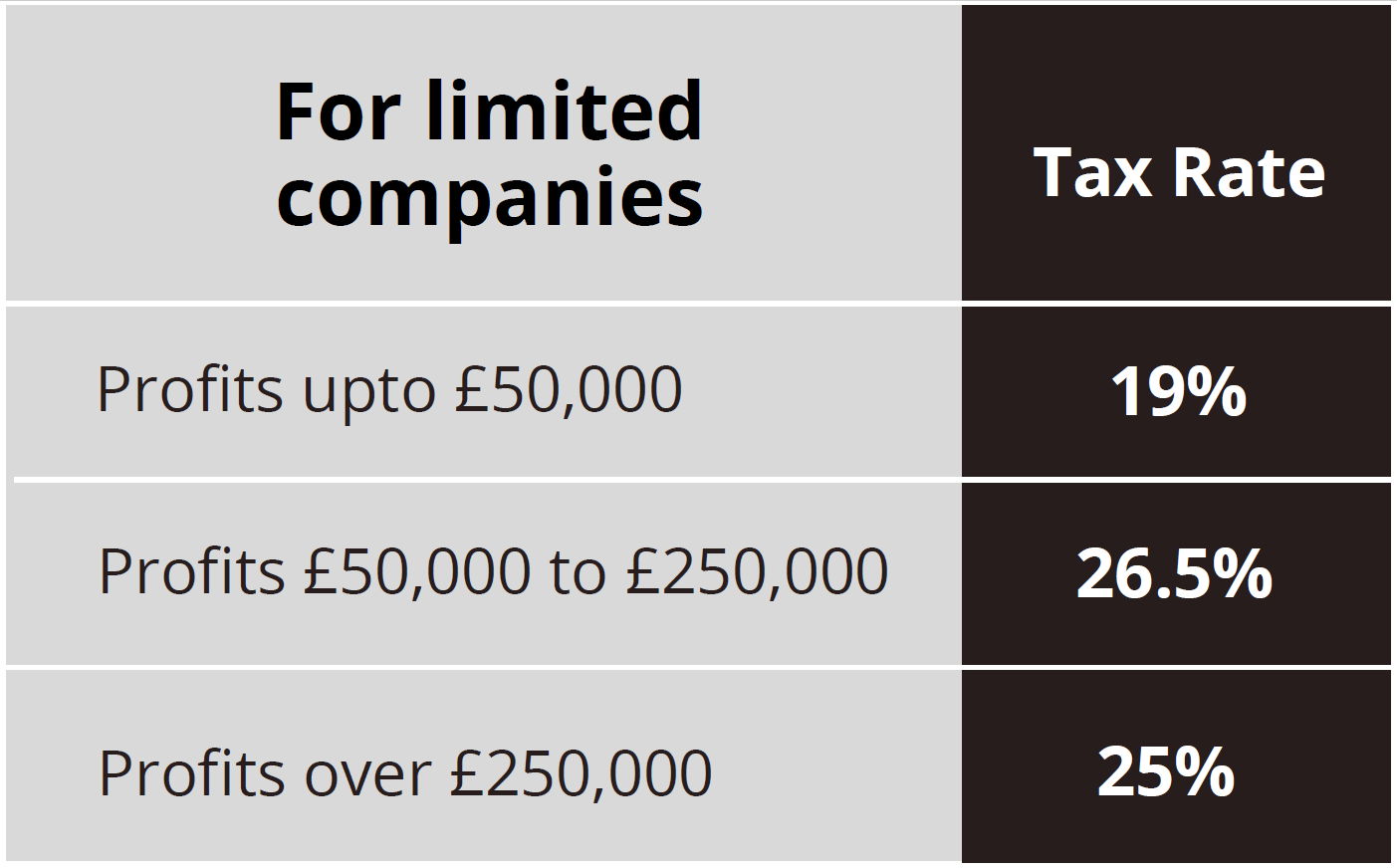

The amount you save in tax will depend on what your tax rate is.

Additional information on capital allowances for limited companies can be found by visiting the HMRC website.

Remember, always consult your accountant in relation to tax and any investment for your practice.

Thinking of investing?

Speak to your dedicated Account Manager today to find out what tax-efficient finance options are available to you.

Susan Marshall

Account Manager (North)

Tel: 07973 793 659

Susan covers the Midlands, North East, North West Scotland, Wales & Northern Ireland.

Pete George

Account Manager (South)

Tel: 07515 580 208

Pete covers East Anglia, London, South East & South West.